Introduction

Companies world-wide rely on Bramasol to help them comply with and benefit from Revenue Recognition regulations ASC 606 and IFRS 15. Our IP, Reporting Tools and Experts can help you to meet them. Our solution includes highly-flexible analytics that provide companies with the specific quantitative information needed to fulfill statutory reporting requirements and are designed to visually surface any set of relevant information needed to support accurate understanding and timely decision making. We use SAP RAR as the core revenue recognition engine with disclosure reports and analytics sitting on top.

Bramasol has created a rich set of management and visualization tools to enhance the modeling, pilot, implementation and transition processes. SAP RAR can go-deep on any aspect of revenue recognition and the Bramasol enhancements are designed to visually surface any set of relevant information needed to support accurate understanding and timely decision making.

Bramasol has taken proactive steps to help companies stay ahead of the curve by developing a collection of specific reports and analytics for public entities to meet ASC 606-10-50x disclosure reporting requirements.

Quote from Presentation of SEC Chief Accounting Office to Bloomberg BNA

From a preliminary look at recent Forms 10-K and 10-Q filings, we continue to be encouraged by the number of companies that have enhanced their transition disclosure. However, I observe that some companies indicate that the impact of the new revenue standard is not expected to be material. The changes in the new revenue standard will impact nearly all companies. Even if the extent of change on the balance sheet or income statement is not deemed to be material, the related disclosure may be material.

The scope of the new standard addresses not only amount and timing of revenue but also new comprehensive disclosures about contracts with customers, including the significant reasonable judgements the registrants has made when applying the guidance. Accordingly, the basis of any statement that the impact of the new standard is immaterial should reflect consideration of the full scope of the new standard, which covers recognition, measurement, presentation and disclosure.

Some have suggested that when SAB 74 refers to the “financial statements” it is concerned only with effects on the primary financial statements and not how disclosures in the notes to the financial statements may also be affected. I believe that such view misses the definition of financial statement, which includes the accompanying notes.

Functionality

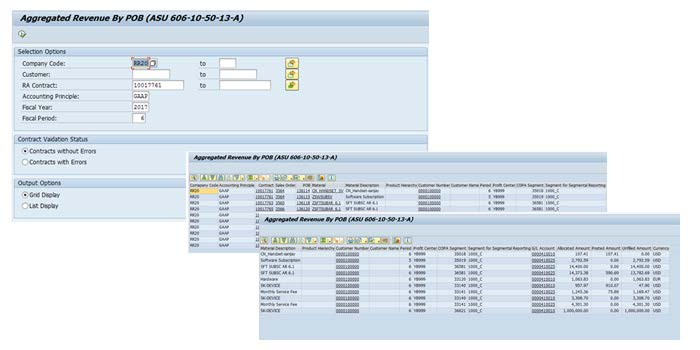

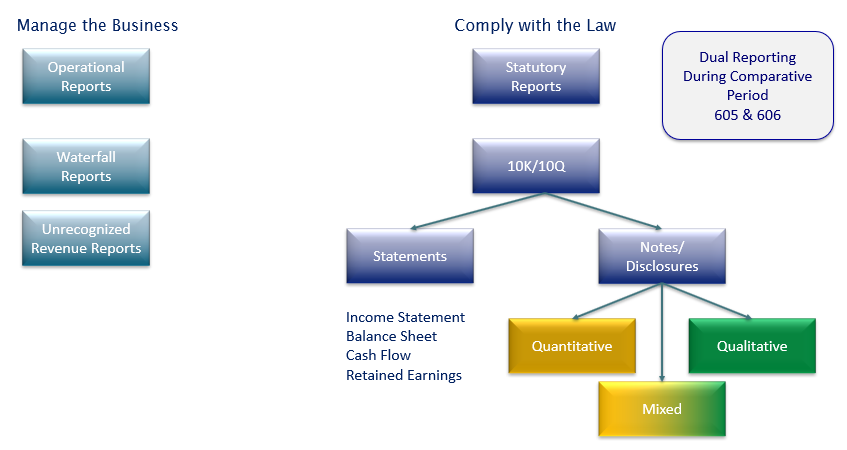

Our complete Revenue Recognition Disclosure solution is comprised of both reports and analytics.

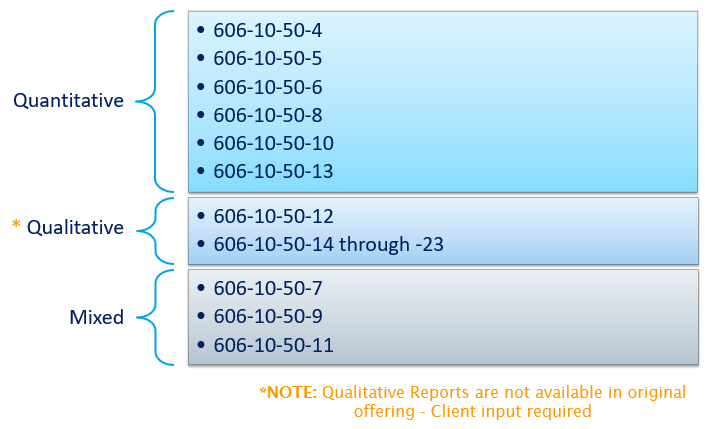

Our report package includes 11 Revenue Recognition Disclosure reports developed in either ECC or BW. These reports include disclosure quantitative, qualitative, and mixed report data.

Reporting consists of 23 sections and 5 Categories where multiple reports may be required under each section. Actual reporting requirements are dependent on organization type: Public business entity and Not for profit business entity.

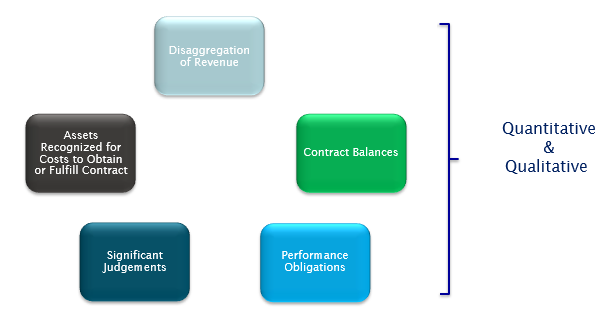

The objective of the disclosure requirements in Topic 606 is for an entity to disclose enough information to enable users of the financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. To meet this objective, the standard includes the following disclosure requirements:

The revenue recognition disclosure reports include the following reports. Please note that to produce Qualitative reports, we need input from the client so these are not included of out the box.

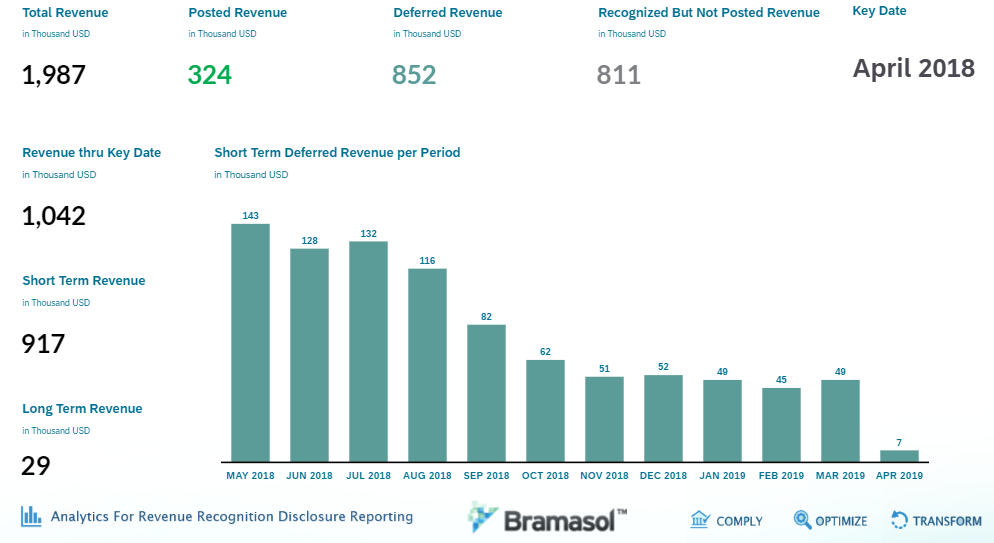

In addition to the above reports, our solution also includes the following story pages developed in SAP Analytics Cloud: Overview Dashboard, Disclosures, Revenue, Schedule, and Segment Summary. Our analytics solution includes 1 boardroom and 1 story based on 4 data models.

The underlying disclosure reports and calculations will be provided as mentioned so the client will be able to expand on and further develop the analytics solution to meet their needs.

Our deferred revenue Overview page shows total deferred revenue rolling up from short term and long-term deferred revenue to total deferred revenue. We’ve got a short term deferred revenue chart going out over the next 12 months. We are also showing indicators for Posted Revenue, Deferred Revenue, and Recognized but not Posted Revenue.

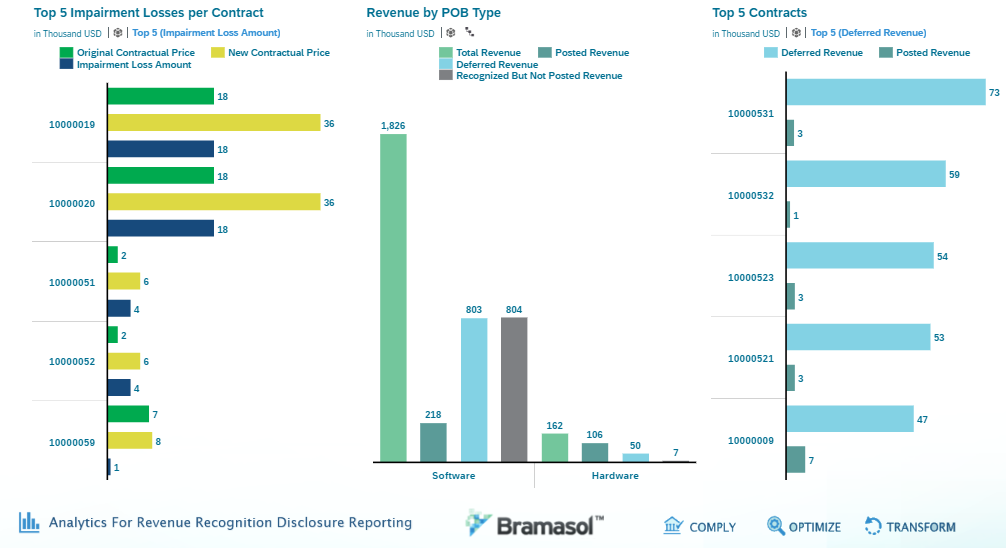

Our Disclosures page breaks up your Impairment Loss per Contract and Revenue by Contracts and POB Type. This is an interactive page allowing you to drill down and drill up on different POB Types and Contracts.

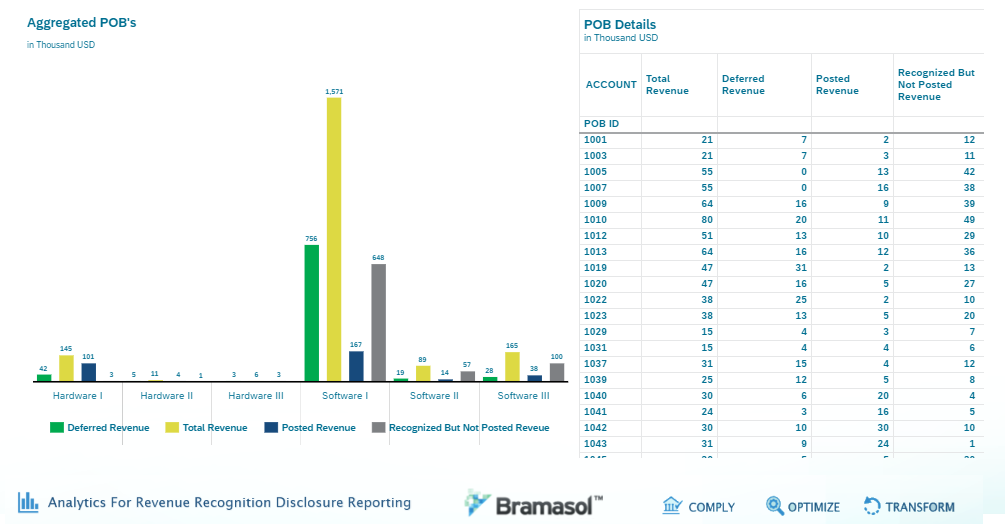

Our Revenue page shows aggregated POBs with a POB Details report.

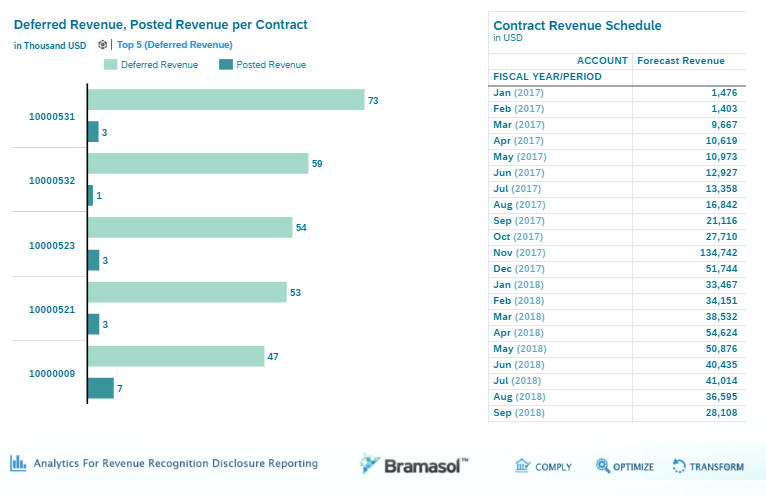

Our Schedule page shows your deferred revenue and posted revenue by contract as well as your Contract Revenue Schedule

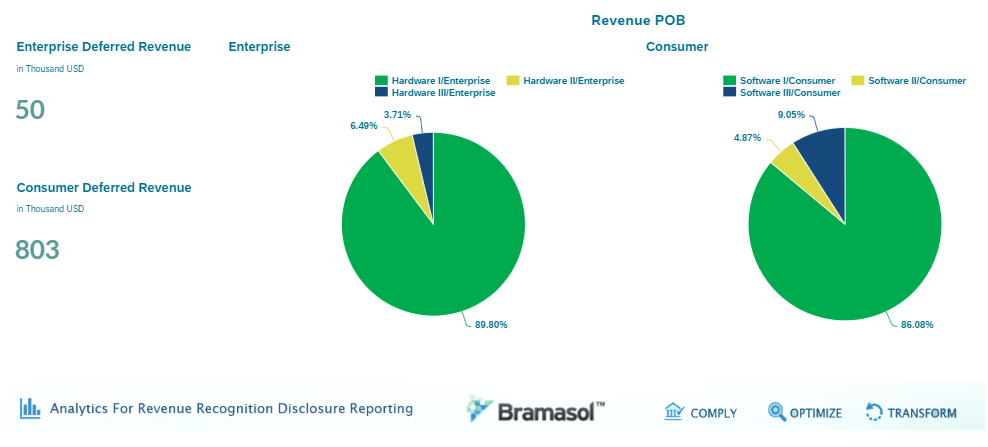

Finally, our Segment Summary page breaks down revenue by segment and POB type.

Solution Scope

Included in this solution are the 11 disclosure reports and our analytics solution built on SAP Analytics Cloud.

Solution Out of Scope

Not included in this solution is the cost of implementing SAP’s RAR solution or any platform licenses related to SAP Analytics Cloud. Please contact us to discuss how we can help in these areas.

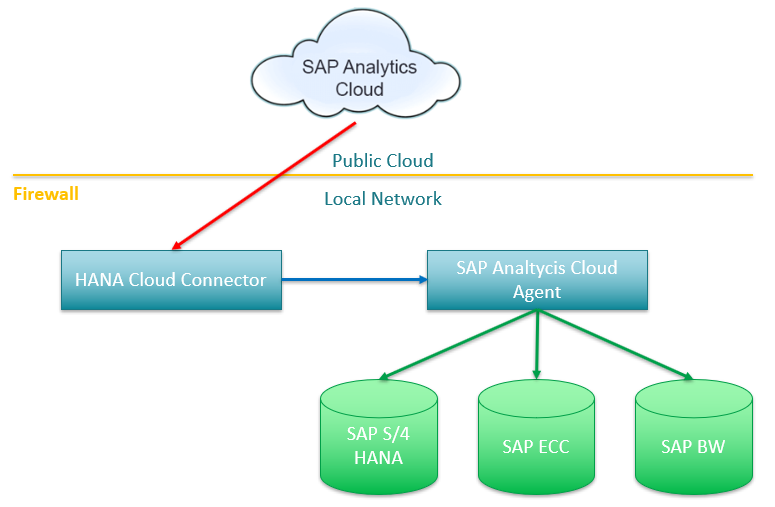

Architecture

Our solution is an end-to-end complete solution that connects to backend on-premise applications running core finance and revenue recognition software with SAP Analytics Cloud.