Streamline capital management and liquidity accounting processes by integrating data from multiple sources onto a single platform. You can use real-time access to accurate information to analyze cash positions by country, currency, company code, or bank.

Streamline capital management and liquidity accounting processes by integrating data from multiple sources onto a single platform. You can use real-time access to accurate information to analyze cash positions by country, currency, company code, or bank.

Key Capabilities

Keep control of multiple bank accounts and track your global bank balance with streamlined processes for opening, changing, closing, and review¬ing accounts. You can also directly connect with banks and financial institutions using a multibank, digital channel with embedded SWIFT technology.

Reduce the time and effort required to obtain cash information, un¬derstand cash requirements in seconds, and im¬mediately trigger any necessary actions from within the application. You can also conduct in-depth analysis to gain more detailed insights into treasury operations than ever before.

Reduce the need to transfer cash between regions and your dependency on banks with support for centralized in-house cash control. You can address challenges associated with managing fragmented cash balances and payment processes by empowering your treasury professionals.

Key Capabilities

Keep control of multiple bank accounts and track your global bank balance with streamlined processes for opening, changing, closing, and review¬ing accounts. You can also directly connect with banks and financial institutions using a multibank, digital channel with embedded SWIFT technology.

Reduce the time and effort required to obtain cash information, un¬derstand cash requirements in seconds, and im¬mediately trigger any necessary actions from within the application. You can also conduct in-depth analysis to gain more detailed insights into treasury operations than ever before.

Reduce the need to transfer cash between regions and your dependency on banks with support for centralized in-house cash control. You can address challenges associated with managing fragmented cash balances and payment processes by empowering your treasury professionals.

Benefits

Benefits

SAP In-House Cash

SAP In-House Cash is used for processing internal and external payment transactions within a group or company. By using SAP In-House Cash you can reduce the number of external bank accounts you hold and the volume of foreign payments you have to make. SAP In-House Cash is implemented at a central location within a group of companies, for example, in head office.

With SAP In-House Cash, you can process the following transactions:

-

Internal payments

-

Central payments

-

Local payments

-

Central incoming payments

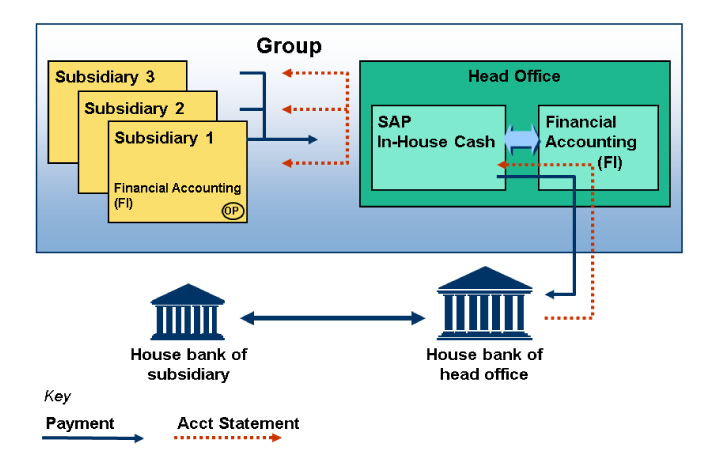

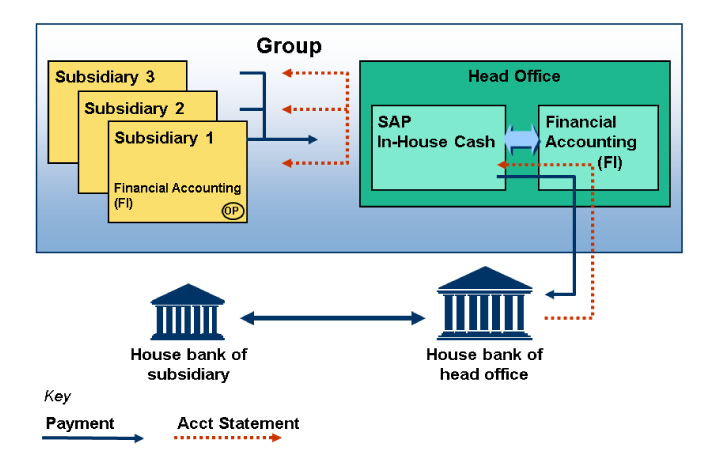

The following graphic shows the flow of data within a group of companies that uses SAP In-House Cash in its head office.

To use the In-House Cash functions, make the necessary system settings in the Implementation Guide (IMG) by choosing Financial Supply Chain Management In-House Cash.

Make the following settings in the implementation guide (IMG) under Financial Accounting for the subsidiary companies and head office.

SAP In-House Cash is connected to the head office’s Financial Accounting (FI) system, and uses its functions, such as the payment program. The affiliated companies also use Financial Accounting (FI) functions. For instance, they also use the payment program to clear open items. The IDocs generated as a result automatically forward payment orders to the in-house cash center. Electronic account statements for the house bank of the head office can be imported to Financial Accounting (FI), and the data is passed on to the in-house cash center. The affiliated companies also receive an account statement from the in-house cash center.

If you create an IHC financial status , you can forward this to SAP Cash Management.

The main component of SAP In-House Cash is the in-house cash center which processes payments between the various subsidiary companies. The in-house cash center is basically a virtual internal bank where subsidiaries hold current accounts. Current account processing depicts receivables and payables between the in-house cash center and affiliated subsidiary companies. It calculates the turnover and balances of the current accounts and forwards this information in summarized form to Financial Accounting (FI).

Process Variants

SAP In-House Cash is used for processing internal and external payment transactions within a group or company. By using SAP In-House Cash you can reduce the number of external bank accounts you hold and the volume of foreign payments you have to make. SAP In-House Cash is implemented at a central location within a group of companies, for example, in head office.

With SAP In-House Cash, you can process the following transactions:

-

Internal payments

-

Central payments

-

Local payments

-

Central incoming payments

The following graphic shows the flow of data within a group of companies that uses SAP In-House Cash in its head office.

To use the In-House Cash functions, make the necessary system settings in the Implementation Guide (IMG) by choosing Financial Supply Chain Management In-House Cash.

Make the following settings in the implementation guide (IMG) under Financial Accounting for the subsidiary companies and head office.

SAP In-House Cash is connected to the head office’s Financial Accounting (FI) system, and uses its functions, such as the payment program. The affiliated companies also use Financial Accounting (FI) functions. For instance, they also use the payment program to clear open items. The IDocs generated as a result automatically forward payment orders to the in-house cash center. Electronic account statements for the house bank of the head office can be imported to Financial Accounting (FI), and the data is passed on to the in-house cash center. The affiliated companies also receive an account statement from the in-house cash center.

If you create an IHC financial status , you can forward this to SAP Cash Management.

The main component of SAP In-House Cash is the in-house cash center which processes payments between the various subsidiary companies. The in-house cash center is basically a virtual internal bank where subsidiaries hold current accounts. Current account processing depicts receivables and payables between the in-house cash center and affiliated subsidiary companies. It calculates the turnover and balances of the current accounts and forwards this information in summarized form to Financial Accounting (FI).