In 2018, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) announced the release of new accounting standards that defined how organizations must account for leases. The release of these leasing stan¬dards was far more than just an accounting change, it was an event that had profound implications on lease/buy decisions, internal process coordination and financial reporting.

Since being introduced in 2004, SAP Contract and Lease Management has gone through many updates and improvements. More recently it was expanded to cover IFRS16 as part of a co-innovation with SAP customers and accounting partners. Since these standards were released in 2018, all of us have learned a great deal about these requirements. The requirements of these standards are complex and can be resource intensive. I have never had a customer tell me the interpretation and compliance with these standards was easier than they thought it would be.

In 2018, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) announced the release of new accounting standards that defined how organizations must account for leases. The release of these leasing stan¬dards was far more than just an accounting change, it was an event that had profound implications on lease/buy decisions, internal process coordination and financial reporting.

Since being introduced in 2004, SAP Contract and Lease Management has gone through many updates and improvements. More recently it was expanded to cover IFRS16 as part of a co-innovation with SAP customers and accounting partners. Since these standards were released in 2018, all of us have learned a great deal about these requirements. The requirements of these standards are complex and can be resource intensive. I have never had a customer tell me the interpretation and compliance with these standards was easier than they thought it would be.

Challenges to Comply with Lease Accounting Standards

One thing SAP has been told from our global customers is there are wide variations in the interpretation of these standards, especially across geographic regions. This means, a lease accounting solution needs to be flexible and customizable to support a wide variety of customer and regional requirements.

Another important learning is robust support for the lease modification process is crucial for accurate compliance. It is important to remember that a lease is not stagnant but a living document which changes many times over its lifecycle. Some of these changes require modifications to the lease accounting. Possible lease modifications are:

Challenges to Comply with Lease Accounting Standards

One thing SAP has been told from our global customers is there are wide variations in the interpretation of these standards, especially across geographic regions. This means, a lease accounting solution needs to be flexible and customizable to support a wide variety of customer and regional requirements.

Another important learning is robust support for the lease modification process is crucial for accurate compliance. It is important to remember that a lease is not stagnant but a living document which changes many times over its lifecycle. Some of these changes require modifications to the lease accounting. Possible lease modifications are:

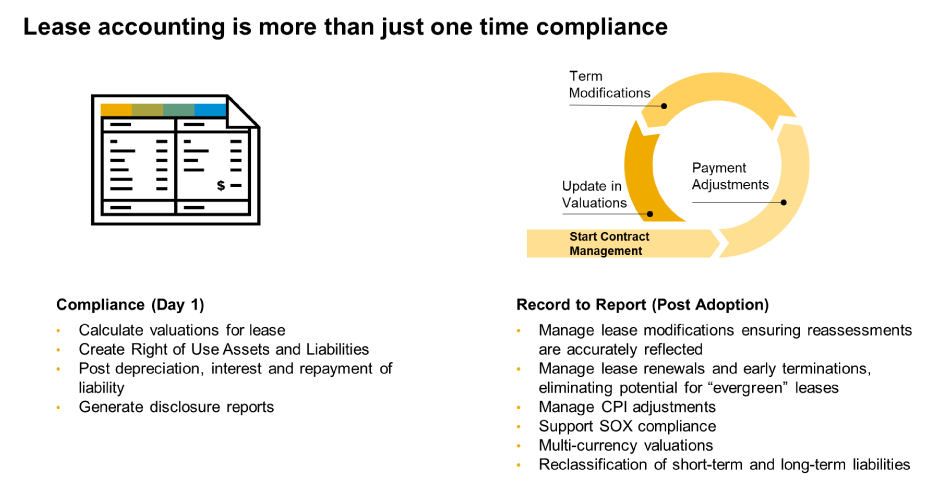

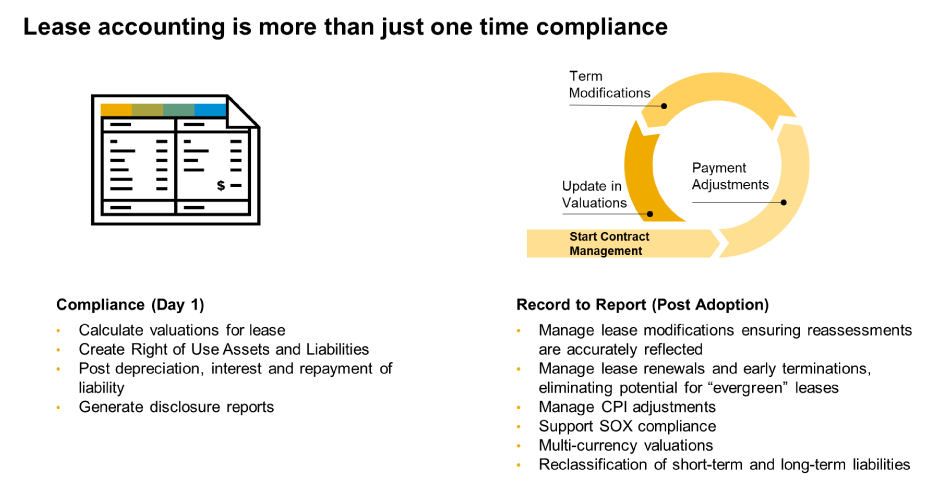

Lease Accounting is Continuous Process

Lease Accounting is Continuous Process

While enhancing SAP Contract and Lease Management for IFRS16, the development team had a pretty good understanding of lease modifications and that our integrated solution uniquely positioned SAP to handle lease modifications in a way far superior than other leasing solutions. However, as we have supported our customers through their lease modification processes, it became apparent that some customers needed more robust functionality in key areas such as managing the start of consideration, proportional interest calculations for early terminations, and the ability to combine multiple term/scope changes within the same accounting period. They also need a way to keep depreciation periods independent of interest calculation methods.

While enhancing SAP Contract and Lease Management for IFRS16, the development team had a pretty good understanding of lease modifications and that our integrated solution uniquely positioned SAP to handle lease modifications in a way far superior than other leasing solutions. However, as we have supported our customers through their lease modification processes, it became apparent that some customers needed more robust functionality in key areas such as managing the start of consideration, proportional interest calculations for early terminations, and the ability to combine multiple term/scope changes within the same accounting period. They also need a way to keep depreciation periods independent of interest calculation methods.

Supporting customers with OSS note 3012918

To help customers better understand some of the functional changes delivered by OSS note 3012918, SAP Development has provided a short video that describe these changes and demonstrate how they appear in SAP Contract and Lease Management. Some of the examples featured in this video include:

Supporting customers with OSS note 3012918

To help customers better understand some of the functional changes delivered by OSS note 3012918, SAP Development has provided a short video that describe these changes and demonstrate how they appear in SAP Contract and Lease Management. Some of the examples featured in this video include:

Use of different Start of Consideration dates within a month

After application of note 3012918, it is now possible to generate consecutive valuation levels on any day within the period. It is no longer required to set the Start of Consideration to the first day of the month.

Use of different Start of Consideration dates within a month

After application of note 3012918, it is now possible to generate consecutive valuation levels on any day within the period. It is no longer required to set the Start of Consideration to the first day of the month.

Combination of term and scope reduction

Another improvement to support lease modifications is the ability to combine a scope reduction (valuation behavior “reduction”) with a term reduction in the same period.

It is important to note the consideration of term reductions must still be activated using the so-called Business Add-In (BADI) parameter CF_CONSIDER_TERM_REDUCTION (see SAP Note 2586090, point 4). However, the application of a term reduction is no longer restricted to the valuation behavior “Absolute Difference” and it can be combined with other valuation behaviors.

Combination of term and scope reduction

Another improvement to support lease modifications is the ability to combine a scope reduction (valuation behavior “reduction”) with a term reduction in the same period.

It is important to note the consideration of term reductions must still be activated using the so-called Business Add-In (BADI) parameter CF_CONSIDER_TERM_REDUCTION (see SAP Note 2586090, point 4). However, the application of a term reduction is no longer restricted to the valuation behavior “Absolute Difference” and it can be combined with other valuation behaviors.

Restructuring of the valuation log

The calculation results are now available for each step in the valuation log. Within this log you can now see all the values and procedures that were used in the calculation. This provides greater transparency and traceability into the valuation calculation.

Restructuring of the valuation log

The calculation results are now available for each step in the valuation log. Within this log you can now see all the values and procedures that were used in the calculation. This provides greater transparency and traceability into the valuation calculation.

No aggregation of clearing postings with the same due date

On the Clearing tab of the valuation results, you can now see all the payment items that will be posted, even when the due dates of the clearing items are the same. This makes it easier to reconcile and trace all payments that reduce the lease liability.