Customer Stories

Bramasol, the leader in SAP Revenue Recognition

Companies worldwide rely on the expertise and experience of Bramasol to help them comply with and benefit from ASC 606 and IFRS 15. Our IP, Reporting Tools and Comply/Optimize/Transform framework can help you turn Compliance into Competitive Advantage.

If you want to truly take advantage of new insights and processes for revenue accounting, then you need a partner who can:

-

Get you ready

-

Deliver complex solutions effectively leveraging our project proven Ignite Methodology and IP

-

Accelerate and streamline creation of Disclosure reports that are FASB compliant and deliver drill down, drill through and drill back capability

-

Improve User Adoption through change management and tailored training programs

-

Bring industry leading experts your team with practical, hands-on knowledge and experience

Bramasol is the Revenue Accounting and Recognition leader and a recognized SAP Revenue Recognition services partner for companies seeking to implement the ASC 606 and IFRS 15 standards. Our SAP-certified experts, participated in the majority of early product Ramp-ups and have worked on more SAP RevRec projects than any other company. We have the experience, expertise and tools to help your company comply with and take advantage of the new standards. Leveraging our Comply/Optimize/Transform framework we can help you leverage your revenue accounting process and data to drive competitive advantage with deep insights into customer behaviour, product insights and overall take rates for downstream services.

Bramasol’s Ignite Methodology is grounded in the SAP Activate methodology and is tailored based on dozens of successful compliance projects to accelerate compliance with ASC 606 and IFRS 15. We offer a suite of tools to help with complex topics such as variable consideration, forecast true-up, transit delays and stand-alone selling price.

THE NEW STANDARDS

On July 9, 2015, the FASB and the International Accounting Standards Board (IASB) issued guidance deferring compliance with the new standards, ASC 606 and IFRS 15 to January 1, 2018. Public companies have until January 1, 2018 to comply with the new standards. And, if you plan on at least two periods of parallel reporting, you have even less time to get ready. Will you be #RevRecReady?

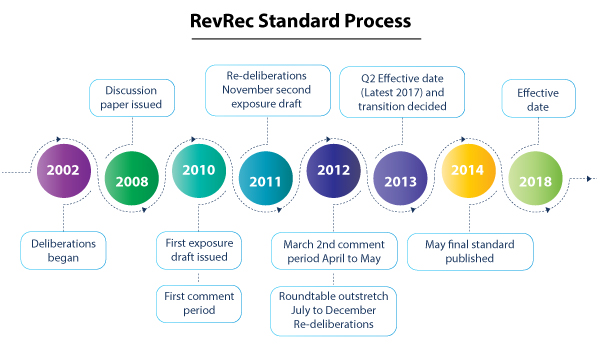

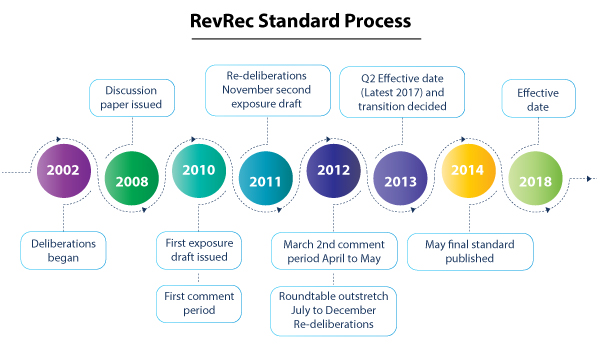

The current standards recommendations are a culmination of many years of deliberation, consultation, and work on the part of FASB and the IASB to harmonize the way companies calculate and report deferred revenue.

The objective of the new guidance is to establish the principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from contracts with customers. The new guidance:

-

Removes inconsistencies and weaknesses in existing revenue requirements

-

Provides a more robust framework for addressing revenue issues

-

Improves comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets

-

Provides more useful information to users of financial statements through improved disclosure requirements

-

Simplifies the preparation of financial statements by reducing the number of requirements to which an organization must refer

SAP has been there since the beginning. Starting in 2009, SAP has been at the table with participation from their chief accountant in recommendations, commentary and deliberation on the new standards.

THE NEW STANDARDS

On July 9, 2015, the FASB and the International Accounting Standards Board (IASB) issued guidance deferring compliance with the new standards, ASC 606 and IFRS 15 to January 1, 2018. Public companies have until January 1, 2018 to comply with the new standards. And, if you plan on at least two periods of parallel reporting, you have even less time to get ready. Will you be #RevRecReady

The current standards recommendations are a culmination of many years of deliberation, consultation, and work on the part of FASB and the IASB to harmonize the way companies calculate and report deferred revenue.

The objective of the new guidance is to establish the principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from contracts with customers. The new guidance:

-

Removes inconsistencies and weaknesses in existing revenue requirements

-

Provides a more robust framework for addressing revenue issues

-

Improves comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets

-

Provides more useful information to users of financial statements through improved disclosure requirements

-

Simplifies the preparation of financial statements by reducing the number of requirements to which an organization must refer

SAP has been there since the beginning. Starting in 2009, SAP has been at the table with participation from their chief accountant in recommendations, commentary and deliberation on the new standards.

The New SAP Revenue Accounting and Reporting Solution (Learn More…)

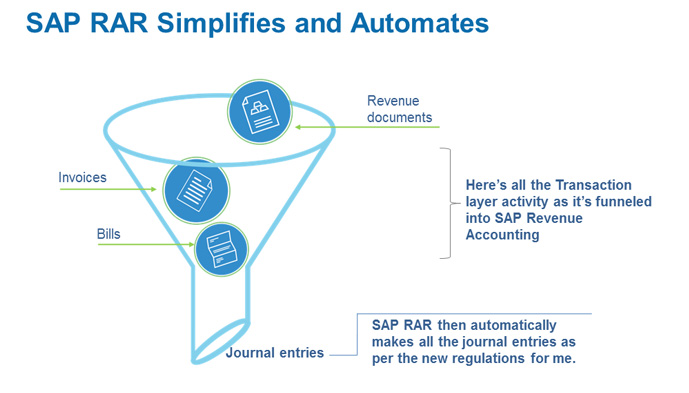

To support customers with this new standard, SAP has completed a multi-year development effort and has created SAP Revenue Accounting and Reporting to be ASC 606 and IFRS 15 compliant from the ground. Starting with the first release in 2015, SAP has continued to add features to address requirements laid out in the new regulations. The most recent release, SAP RAR 1.3 FP08 is the latest feature rich offering from SAP and completes the journey to “SD RevRec Parity.” Offering features such as drop shipment, proof of delivery and call off order support it is the most robust solution available today for Revenue Accounting. SAP RAR simplifies and automates even complex revenue accounting processes for companies large and small and is the solution that was designed from the ground up with the latest Revenue Recognition Standards in mind. SAP RAR 1.3 FP08 is available on premise or for single tenant cloud.

Click here to learn more about SAP RAR