Bramasol works with you to evaluate the system changes needed under the new regulations, determine how significant they will be going forward, and lay out a path toward implementation with an emphasis on the impact to the SAP system. As the leading consulting partner for SAP CLM, we provide a holistic view to the impact the new Leasing standard will have on your organization. Our methodology and approach will help ensure that you can meet the upcoming changes to the standards.

As public companies have worked over the past two years to comply with new ASC 842 and IFRS 16 leasing standards, they have taken a variety of paths to achieve the initial compliance requirements. However, those companies that took a limited approach using standalone solutions or spreadsheets are now discovering they’re stuck in a dead-end with regard to integrating and optimizing lease compliance within their overall business operations.

Bramasol, the leader in SAP Contract and Lease Management

Don’t settle for a solution that is less than the best or a partner who isn’t the leader. With SAP and Bramasol, you get both. SAP Contract and Lease Management is the only one certified by a Big 4. With Bramasol and SAP CLM we can make it all possible. With deep expertise in lease accounting, we are not only product experts, but solution experts who help guide you through the process of selecting, designing, implementing and supporting your lease solution to obtain maximum value, quickly and cost effectively. Using our Ignite methodology we deliver a solution that not only complies with ASC 842 and IFRS 16, but is natively integrated with your SAP finance system (or any other) and is secure, scalable, and flexible. Check out why the Fortune 500 choose Bramasol.

The New Standards

On January 06, 2016, the International Accounting Standards Board (IASB) issued International Financial Reporting Standards (IFRS) 16 Leases. IFRS 16 replaces several accounting standards and interpretations including: International Accounting Standard (IAS) 17, International Finance Reporting Interpretations Committee (IFRIC) 4, Standing Interpretations Committee (SIC) 15, and SIC-27. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases.

Accounting Standards Update – March 2023

On February 25, 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842) also known as Accounting Standards Codification (ASC) 842. The new leasing standard ASC-842 presents dramatic changes to the balance sheets of lessees. Lessor accounting is updated to align with certain changes in the lessee model and the new revenue recognition standard ASC-606. The new leasing standard ASC-842 supersedes ASC-840 and was issued to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.

Both IFRS 16 and ASC 842 are the result of the International Accounting Standards Board’s (IASB’s) and Financial Accounting Standards Board’s (FASB’s) efforts to meet that objective of improved transparency and comparability while improving financial reporting.

Just as the new Revenue Recognition standard (IFRS 15 and ASC 606) was a joint project between the FASB and IASB, the Leasing project began in a similar manner with many of the requirements in Topic 842 the same as the requirements in IFRS 16. However, unlike the converged standard for Revenue Recognition (IFRS 15 and ASC 606), the new leasing standard is not converged. This means there are differences in how the two accounting standards handle certain accounting transactions.

The main differences between Topic 842 and IFRS 16 are in relation to certain aspects of the lessee accounting model. In contrast to the lessee accounting model in Topic 842, which distinguishes between finance leases and operating leases in the financial statements, the lessee accounting model in IFRS 16 requires all leases to be accounted for consistent with the Topic 842 approach for finance leases. Consequently, leases classified as operating leases under Topic 842 will be accounted for differently under GAAP than under IFRS and will have a different effect on the statement of comprehensive income and the statement of cash flows under IFRS 16 than under previous IFRS standards. Whether you are just beginning your introduction into the topic of Leasing or are well underway with your project to implement the new standards, Bramasol has the experience, resources, and industry knowledge to help you take advantage of this opportunity to transform your business.

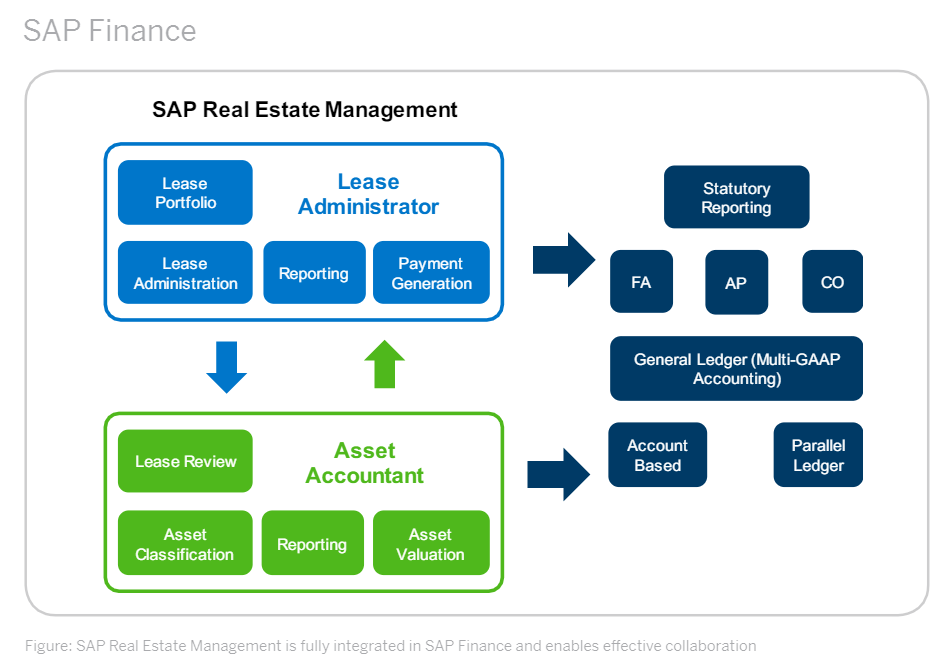

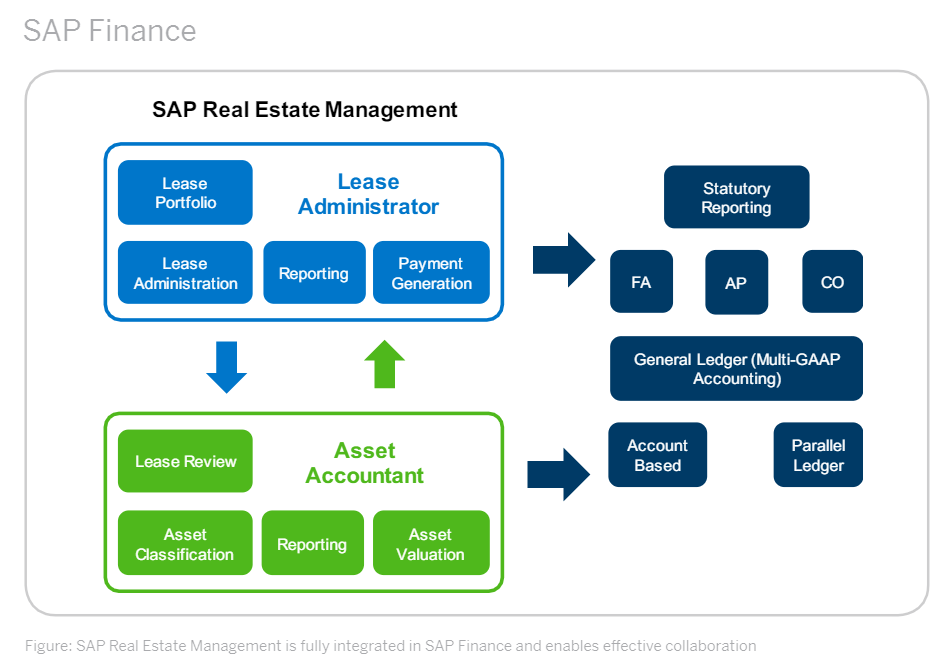

SAP Real Estate Management

Whether you have operational leases, finance leases, real estate or movables, SAP’s Contract and Lease Management is the only product certified by PWC to make the correct calculations, post proper journal entries and to have a robust development process that moves forward. SAP has completed a multi-year development effort to improve their SAP Real Estate Management offering. SAP Real Estate Management enables close collaboration between the lease administrator, lease accountant, and fixed asset accountant. They access the same lease record, with all calculations being based on the terms and conditions of the abstracted lease. The lease transaction in SAP Real Estate Management provides separate authorizations to ensure a clear separation of duties. In addition to capturing contract terms and conditions.

In addition to lease accounting SAP Real Estate Management is specifically designed to support real estate leasing processes such as managing critical dates, exercising renewal options, early terminations, rent escalations, sales based rent, common area maintenance, and service charge settlement. Lease administrators can attach all leasing documents to the SAP Lease Contact as well as store notes and generated correspondence. The highly flexible and extendable forms collect industry- or business-specific attributes and enables users to stay ahead of the game. Periodic posting runs automatically generate all lease payments based on the terms of the current lease agreement with real-time integration into SAP Financials.

Click here to learn more about SAP Real Estate Management

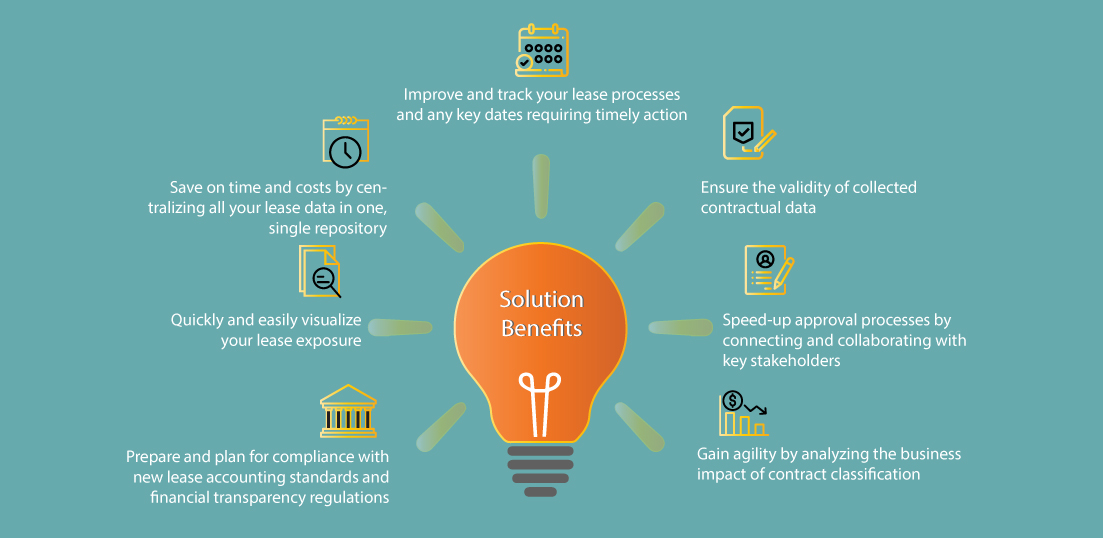

Streamline, trace, and integrate all the data collected on existing and new leases.

Solution Benefits:

-

Prepare and plan for compliance with new lease accounting standards and financial transparency regulations

-

Quickly and easily visualize your lease exposure

-

Save on time and costs by centralizing all your lease data in one, single repository

-

Improve and track your lease processes and any key dates requiring timely action

-

Ensure the validity of collected contractual data

-

Speed-up approval processes by connecting and collaborating with key stakeholders

-

Gain agility by analyzing the business impact of contract classification

SAP Cloud for Real Estate (Learn More…)

Who says you can’t have it all in the cloud? With SAP’s Real Estate for Cloud you get a robust solution that provides the functionality you expect from the leader in ERP and Finance Transformation combined with all the benefits of the Cloud. With SAP Real Estate for Cloud you can experience a modern User Interface, deep functionality, and low maintenance in a SaaS offering.

And Bramasol, pioneers in SAP Cloud, can help deliver this to you. With over a decade of SAP Cloud solution delivery experience we bring a fit to standard approach based on deep project proven experience to help you get the most from a cloud program. Our Ignite methodology delivers value quickly and provides the change management and training you need to ensure high user adoption and a quick Time to Value. Ask us how.

Click here to learn more about SAP Cloud for Real Estate.

Bramasol Approach – Key Steps

Bramasol works with you to evaluate the system changes needed under the new regulations, determine how significant they will be going forward, and lay out a path toward implementation with an emphasis on the impact to the SAP system. As the leading consulting partner for SAP CLM, we provide a holistic view to the impact the new Leasing standard will have on your organization. Our methodology and approach will help ensure that you can meet the upcoming changes to the standards.

Bramasol’s Lease Conversion Program

To comply quickly with the existing standards, many companies chose interim solutions that made big promises but were short on delivery. Others, chose to stick with brute force methods. They all promised:

-

Easy Implementation at a low cost

-

Fully integrated to your ERP solution with bidirectional feeds

-

Robust reporting and disclosures

-

Deep functionality including 445 Calendars, complex foreign exchange, real estate and movables, and complete life-cycle management

-

Easy to maintain because it’s in the cloud

Companies that chose standalone solutions were promised a great deal, but when we talk with clients and prospects, they tell us it wasn’t true. Most tell us they got far more than they bargained for in costs and far less in functionality. Most want to move to an integrated solution but don’t want another 6 to 12 month project costing half a million dollars or more.

What if you could have a solution that:

-

Is fully Integrated with SAP, now and in the future

-

Leverages the same SAP Master Data, including vendor, asset, foreign currency and GL without replication or separate file updates

-

Has FASB and IASB Compliant disclosure reports that provide drill down, drill through AND drill back capability

-

Is certified by a Big Four accounting firm to provide correct accounting and journal entries

And what if you could have that solution up and running in about 9 weeks?

With SAP Contract and Lease Management (CLM) and Bramasol you can have it all and more. CLM is the most comprehensive and feature rich leasing solutions for SAP users and is fully integrated with SAP ERP and SAP S/4HANA. Together with Bramasol’s Disclosure Reporting Tools, it provides comprehensive disclosure reporting capabilities in accordance with ASC 842 and IFRS 16, while allowing you to drill down from the highest level to the lowest and even back to the actual lease contract or asset with just a mouse click. And, because SAP partnered with PWC to certify the solution you can rest assured that you will spend less time proving out to your auditors that you have complied.

Click here to learn more and set an appointment with our experts who will work with you to arrange a no cost audit and conversion consultation to help you understand how you can move to a fully integrated, robust solution that is as good Day 2 as it was Day 1.

Are you #LeasingReady

Customer Testimonials

Bramasol works with you to evaluate the system changes needed under the new regulations, determine how significant they will be going forward, and lay out a path toward implementation with an emphasis on the impact to the SAP system. As the leading consulting partner for SAP CLM, we provide a holistic view to the impact the new Leasing standard will have on your organization. Our methodology and approach will help ensure that you can meet the upcoming changes to the standards.

As public companies have worked over the past two years to comply with new ASC 842 and IFRS 16 leasing standards, they have taken a variety of paths to achieve the initial compliance requirements. However, those companies that took a limited approach using standalone solutions or spreadsheets are now discovering they’re stuck in a dead-end with regard to integrating and optimizing lease compliance within their overall business operations.

Bramasol, the leader in SAP Contract and Lease Management

Don’t settle for a solution that is less than the best or a partner who isn’t the leader. With SAP and Bramasol, you get both. SAP Contract and Lease Management is the only one certified by a Big 4. With Bramasol and we can make it all possible. With deep expertise in lease accounting, we are not only product experts, but solution experts who help guide you through the process of selecting, designing, implementing and supporting your lease solution to obtain maximum value, quickly and cost effectively. Using our Ignite methodology we deliver a solution that not only complies with ASC 842 and IFRS 16, but is natively integrated with your SAP finance system (or any other) and is secure, scalable, and flexible. Check out why the Fortune 500 choose Bramasol.

The New Standards

On January 06, 2016, the International Accounting Standards Board (IASB) issued International Financial Reporting Standards (IFRS) 16 Leases. IFRS 16 replaces several accounting standards and interpretations including: International Accounting Standard (IAS) 17, International Finance Reporting Interpretations Committee (IFRIC) 4, Standing Interpretations Committee (SIC) 15, and SIC-27. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases.

Accounting Standards Update – March 2023

On February 25, 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842) also known as Accounting Standards Codification (ASC) 842. The new leasing standard ASC-842 presents dramatic changes to the balance sheets of lessees. Lessor accounting is updated to align with certain changes in the lessee model and the new revenue recognition standard ASC-606. The new leasing standard ASC-842 supersedes ASC-840 and was issued to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.

Both IFRS 16 and ASC 842 are the result of the International Accounting Standards Board’s (IASB’s) and Financial Accounting Standards Board’s (FASB’s) efforts to meet that objective of improved transparency and comparability while improving financial reporting.

Just as the new Revenue Recognition standard (IFRS 15 and ASC 606) was a joint project between the FASB and IASB, the Leasing project began in a similar manner with many of the requirements in Topic 842 the same as the requirements in IFRS 16. However, unlike the converged standard for Revenue Recognition (IFRS 15 and ASC 606), the new leasing standard is not converged. This means there are differences in how the two accounting standards handle certain accounting transactions.

The main differences between Topic 842 and IFRS 16 are in relation to certain aspects of the lessee accounting model. In contrast to the lessee accounting model in Topic 842, which distinguishes between finance leases and operating leases in the financial statements, the lessee accounting model in IFRS 16 requires all leases to be accounted for consistent with the Topic 842 approach for finance leases. Consequently, leases classified as operating leases under Topic 842 will be accounted for differently under GAAP than under IFRS and will have a different effect on the statement of comprehensive income and the statement of cash flows under IFRS 16 than under previous IFRS standards. Whether you are just beginning your introduction into the topic of Leasing or are well underway with your project to implement the new standards, Bramasol has the experience, resources, and industry knowledge to help you take advantage of this opportunity to transform your business.

SAP Real Estate Management

Whether you have operational leases, finance leases, real estate or movables, SAP’s Contract and Lease Management is the only product certified by PWC to make the correct calculations, post proper journal entries and to have a robust development process that moves forward. SAP has completed a multi-year development effort to improve their SAP Real Estate Management offering. SAP Real Estate Management enables close collaboration between the lease administrator, lease accountant, and fixed asset accountant. They access the same lease record, with all calculations being based on the terms and conditions of the abstracted lease. The lease transaction in SAP Real Estate Management provides separate authorizations to ensure a clear separation of duties. In addition to capturing contract terms and conditions.

In addition to lease accounting SAP Real Estate Management is specifically designed to support real estate leasing processes such as managing critical dates, exercising renewal options, early terminations, rent escalations, sales based rent, common area maintenance, and service charge settlement. Lease administrators can attach all leasing documents to the SAP Lease Contact as well as store notes and generated correspondence. The highly flexible and extendable forms collect industry- or business-specific attributes and enables users to stay ahead of the game. Periodic posting runs automatically generate all lease payments based on the terms of the current lease agreement with real-time integration into SAP Financials.

Click here to learn more about SAP Real Estate Management

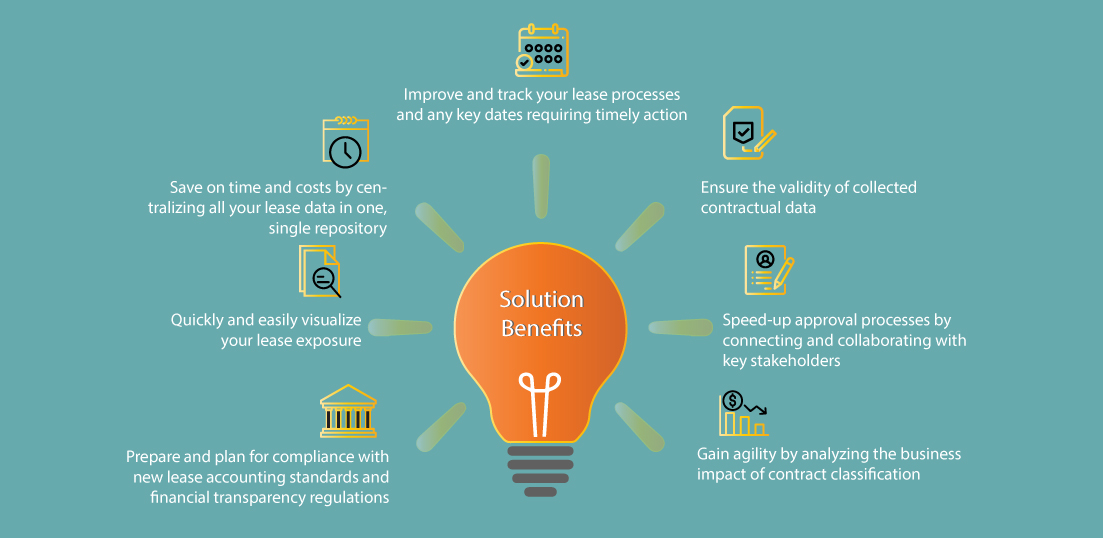

Streamline, trace, and integrate all the data collected on existing and new leases.

Solution Benefits:

-

Prepare and plan for compliance with new lease accounting standards and financial transparency regulations

-

Quickly and easily visualize your lease exposure

-

Save on time and costs by centralizing all your lease data in one, single repository

-

Improve and track your lease processes and any key dates requiring timely action

-

Ensure the validity of collected contractual data

-

Speed-up approval processes by connecting and collaborating with key stakeholders

-

Gain agility by analyzing the business impact of contract classification

Who says you can’t have it all in the cloud? With SAP’s Real Estate for Cloud you get a robust solution that provides the functionality you expect from the leader in ERP and Finance Transformation combined with all the benefits of the Cloud. With SAP Real Estate for Cloud you can experience a modern User Interface, deep functionality, and low maintenance in a SaaS offering.

And Bramasol, pioneers in SAP Cloud, can help deliver this to you. With over a decade of SAP Cloud solution delivery experience we bring a fit to standard approach based on deep project proven experience to help you get the most from a cloud program. Our Ignite methodology delivers value quickly and provides the change management and training you need to ensure high user adoption and a quick Time to Value. Ask us how.

Click here to learn more about SAP Cloud for Real Estate.

Bramasol Approach – Key Steps

Bramasol works with you to evaluate the system changes needed under the new regulations, determine how significant they will be going forward, and lay out a path toward implementation with an emphasis on the impact to the SAP system. As the leading consulting partner for , we provide a holistic view to the impact the new Leasing standard will have on your organization. Our methodology and approach will help ensure that you can meet the upcoming changes to the standards.

Bramasol’s Lease Conversion Program

To comply quickly with the existing standards, many companies chose interim solutions that made big promises but were short on delivery. Others, chose to stick with brute force methods. They all promised:

-

Easy Implementation at a low cost

-

Fully integrated to your ERP solution with bidirectional feeds

-

Robust reporting and disclosures

-

Deep functionality including 445 Calendars, complex foreign exchange, real estate and movables, and complete life-cycle management

-

Easy to maintain because it’s in the cloud

Companies that chose standalone solutions were promised a great deal, but when we talk with clients and prospects, they tell us it wasn’t true. Most tell us they got far more than they bargained for in costs and far less in functionality. Most want to move to an integrated solution but don’t want another 6 to 12 month project costing half a million dollars or more.

What if you could have a solution that:

-

Is fully Integrated with SAP, now and in the future

-

Leverages the same SAP Master Data, including vendor, asset, foreign currency and GL without replication or separate file updates

-

Has FASB and IASB Compliant disclosure reports that provide drill down, drill through AND drill back capability

-

Is certified by a Big Four accounting firm to provide correct accounting and journal entries