If you are looking for maximizing the value of services you receive from banks, improve visibility of balance and transaction information, reduce the cost of maintaining even complex banking structures, and minimize risk and being able to maximize control… We can help.

As the leaders in SAP Finance and Compliance, Bramasol’s experts have developed a comprehensive program to help you answer your question with regards to be ready for new implementations.

With over 20 years of SAP Treasury and Cash Management experience and a team that has support dozens of clients, we can help pinpoint areas where you can save real money, now. Our Banking and Bank Management Assessment will help guide a bank rationalization strategy, maintain and strengthen your global bank network and reduce the time you need to get a clear vision of your cash and cash balances.

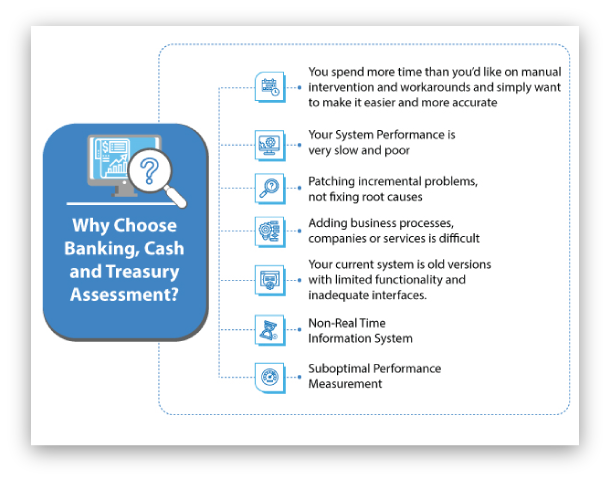

Why Choose Banking and Bank Assessment?

- You have too many bank accounts and want to be more strategic

- Your visibility into your balances and cash could be faster

- You want to leverage tools like In House Cash, netting, pooling or POBO/ROBO

- Thinking how you can free up trapped cash or enable a more flexible, secure and scalable banking platform to support you globally

- You want a more secure, single point of focus for your banking rather than relying on multiple logins or “secure” lines.

If you are looking for maximizing the value of services you receive from banks, improve visibility of balance and transaction information, reduce the cost of maintaining even complex banking structures, and minimize risk and being able to maximize control… We can help.

As the leaders in SAP Finance and Compliance, Bramasol’s experts have developed a comprehensive program to help you answer your question with regards to be ready for new implementations.

With over 20 years of SAP Treasury and Cash Management experience and a team that has support dozens of clients, we can help pinpoint areas where you can save real money, now. Our Banking and Bank Management Assessment will help guide a bank rationalization strategy, maintain and strengthen your global bank network and reduce the time you need to get a clear vision of your cash and cash balances.

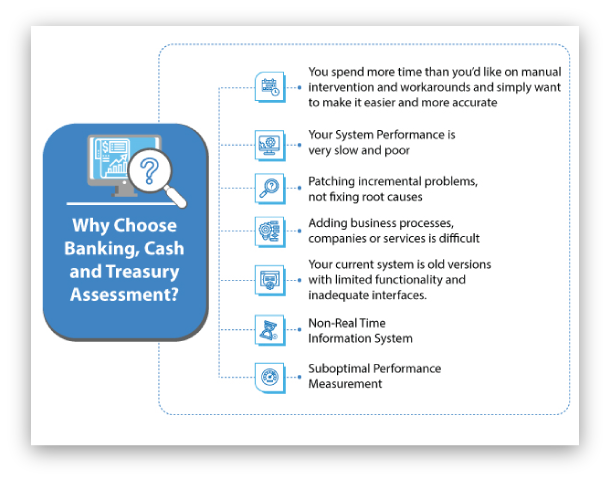

Why Choose Banking and Bank Assessment?

- You have too many bank accounts and want to be more strategic

- Your visibility into your balances and cash could be faster

- You want to leverage tools like In House Cash, netting, pooling or POBO/ROBO

- Thinking how you can free up trapped cash or enable a more flexible, secure and scalable banking platform to support you globally

- You want a more secure, single point of focus for your banking rather than relying on multiple logins or “secure” lines.

What is the Bramasol’s Banking and Bank Management Assessment program

Bramasol’s Banking and Bank Management Assessment program is an in-depth review of your banking and bank management eco-system by our team of experts across 4 main dimensions:

Operational

Evaluates banks, banking statements, bank account analysis, bank flows, fees, hierarchies Multi-Bank Connectivity, Single access point to view cash position and more.

Functional

Looks at how your operations (Process/System/People/Policies) are set up and evaluates if they are consistent with Best Practices. Focuses with laser intensity on manual vs automated operations

Technical

Evaluates the technical aspects of your Banking & Bank Management eco-system comprising your banking statements, bank account analysis, bank flows, fees, hierarchies Multi-Bank Connectivity, Single access point to view cash position and more.

Reporting

Examines your capabilities to generate functional reports for your stakeholders, regulatory agencies, statutory authorities, for making operational decisions and for executing operational transactions. Analyzes your capabilities to generate and measure KPIs by means of analytical, modeling, and simulation tools

Operational

Evaluates banks, banking statements, bank account analysis, bank flows, fees, hierarchies Multi-Bank Connectivity, Single access point to view cash position and more.

Functional

Looks at how your operations (Process/System/People/Policies) are set up and evaluates if they are consistent with Best Practices. Focuses with laser intensity on manual vs automated operations

Technical

Evaluates the technical aspects of your Banking & Bank Management eco-system comprising your banking statements, bank account analysis, bank flows, fees, hierarchies Multi-Bank Connectivity, Single access point to view cash position and more.